VAT & Compulsory Purchase Made Simple

Adrian Maher, Managing Director, aspireCP: May 2020

VAT on compulsory purchase is one of the key areas in which practitioners struggle.

VAT is a tax on the supply of goods and services. In the field of compulsory purchase there are two potential supplies; the first on the sale of land from the claimant to the acquiring authority and the second on the purchase of goods and services by the claimant, which form part of compensation for disturbance. I will deal with each in turn. In both instances the point at which the tax liability is assessed is the date of payment; so there can be many different tax points for one claim. This is relevant where, for example, the tax rate changes over time.

1. VAT on the sale of land to the acquiring authority

The standard VAT rules apply to the sale of land to the acquiring authority whether it is by agreement or pursuant to a GVD or notice to treat. Land is exempt from VAT unless the landowner elects to waive this exemption (also called “opted to tax”). Where the claimant has opted to tax the land, the claimant must invoice the acquiring authority for VAT on all compensation payable for professional fees and disturbance compensation as they are deemed to be part of the supply of land.

2. VAT on disturbance compensation incurred by the claimant

Compensation law says that disturbance compensation forms part of the value of land. It is therefore not surprising that HMRC VAT notice 742 says “Payments described as disturbance are treated as part of the consideration for the supply”. If the claimant has opted to waive their exemption then VAT will be payable on all land and disturbance compensation and be recoverable by the acquiring authority with a valid VAT receipt.

The claimant will not normally be able to recover VAT from HMRC on professional fees and other disturbance costs where they relate to a transfer of exempt land to the acquiring authority. The acquiring authority will pay the gross disturbance compensation and not be able to recover the VAT. However, what happens where the claimant incurs costs as a direct and reasonable consequence of the dispossession (hence qualifying as disturbance compensation) but either no interest is vested/transferred to the acquiring authority or the costs relate to the acquisition of the claimant’s replacement property. This is a grey area but the reason for relocating under a CPO is probably not relevant. We believe the answer is that it depends on whether the disturbance costs directly relate to a business activity which is VAT registered.

VAT should be recoverable on relocation costs by a VAT registered claimant if they are incurred for the purposes of the business (e.g. a shopkeeper is relocating to a new shop). If that is the case, then input tax is recoverable by the claimant on relocation costs because those costs are not directly and immediately linked with the exempt supply of the land at all; rather, they are directly and immediately linked to the continuation of the business. Input VAT is a tax can usually reclaim it from HMRC in full. Claimants are under a duty to mitigate their loss and our experience is that VAT registered businesses normally recover their VAT on such relocation costs through their quarterly VAT returns to HMRC. The net disturbance cost is therefore compensated by the acquiring authority.

It follows that as professional fees are just a type of disturbance compensation then their VAT treatment is the same as the disturbance matter to which they relate. i.e. either the acquisition of the land or the relocation of the business. Certain professional fees such as injurious affection clearly don’t relate to the supply of land and liability for VAT compensation by the acquiring authority will probably depend on whether the claimant is registered for VAT.

It is also worth remembering that the claimant cannot recover VAT from the acquiring authority to the extent that the principal sum upon which it was calculated is not compensatable as it is value for money. If £1,000 is incurred by the claimant and 60% of this is agreed to be compensatable then VAT would be compensatable on £600 and the claimant would not be able to recover VAT on the remainder. The acquiring authority will not be able to recover the VAT on this £600 as there is no supply from the claimant’s suppliers directly to the acquiring authority.

3. Heads of claim outside the scope of VAT

There is no VAT payable on ‘injurious affection’ under either S.7 or S.10 of the Compulsory Purchase Act 1965 nor on Part 1 of the Land Compensation Act 1973 as there is no supply of goods or services to the acquiring authority. Likewise, compensation for both “Loss Payments” and “Statutory Interest” are outside the scope of VAT for the same reason.

4. Recovery of VAT by the acquiring authority

The acquiring authority can recover the VAT it pays where the claimant opts to tax the land it acquires and has received a valid VAT invoice. The acquiring authority should have processes in place requesting VAT invoices early enough so as to receive an invoice in time to make the payment of VAT. It is possible for the acquiring authority to opt to tax land before it is acquired by them.

5. VAT on advance payments

When interim payments are made under S.52 of the Land Compensation Act 1973, the acquiring authority does not generally know whether the claimant has opted to tax the land being acquired or whether the business is VAT registered. The acquiring authority’s S.52 assessment is deemed to be inclusive of VAT unless the acquiring authority explicitly states that their assessment excludes VAT. It is therefore very important for acquiring authorities to make this explicit as they will not be able to recover the VAT from HMRC without a VAT invoice from the claimant and the claimant will not be able to issue such a VAT invoice where they have not opted to tax the land. Acquiring authorities need good systems in place to track the VAT status and optimise recovery, for example the AFiRMS software available from TerraQuest.

Summary

Parties from whom land is compulsorily acquired should be able to recover their VAT to the extent the principal sum is compensatable and not value for money. However, acquiring authorities are much more exposed and will need to carefully consider both opting to tax and their systems. This will optimise the recovery of VAT and ensure they don’t go 20% above budget!

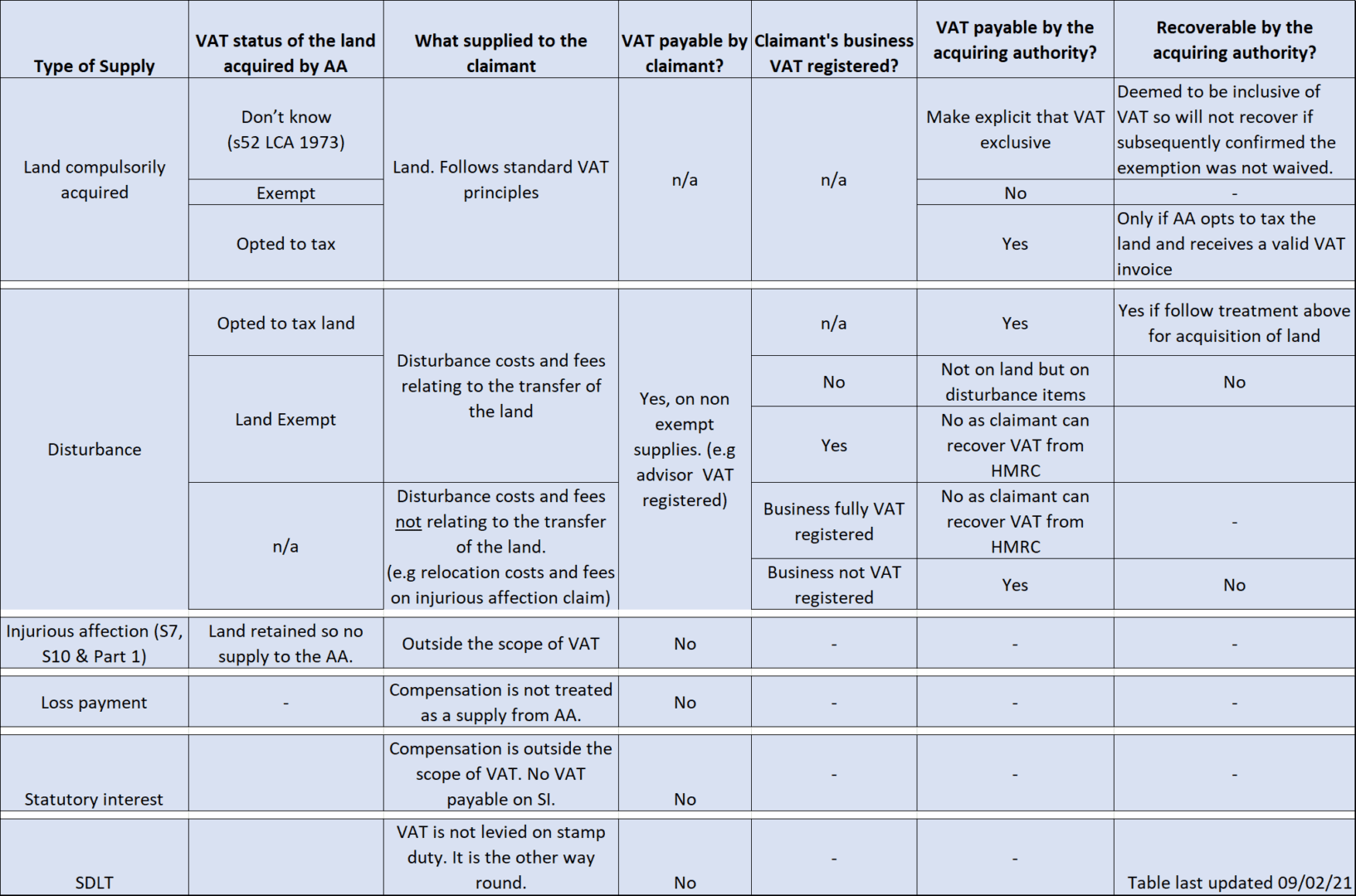

The VAT position for compulsory purchase can summarised as follows:

© Copyright aspireCP LLP 2020

All rights reserved. No part of this article may be reproduced in any form without permission in writing from the copyright owner, except by a reviewer who may quote brief passages in a review providing suitably referenced.

Whilst this article is believed to be correct at the date of issue neither the author nor aspireCP LLP accept any liability for the accuracy or completeness of the information contained in this article.